Transact continues to reduce and simplify its charges with the introduction of a single pension wrapper fee for linked family groups from 1 April 2025.

This follows our previous removal of wrapper fees for junior pensions and junior ISAs, reinforcing Transact’s position as the platform of choice for families and for intergenerational financial planning.

How the new single pension wrapper fee will work:

- A single pension wrapper fee will apply for all Personal Pension (PP) and SIPP wrappers held within a linked family group.*

- The pension wrapper fee (£20 per quarter) can be split equally across a linked family group or allocated to an individual portfolio.

- The single fee applies to PP and SIPP wrappers separately.

This latest reduction is set to benefit new clients and up to 45,000 existing clients with pensions currently in linked family groups (source: Transact).

*Under the current charging structure, each client incurs a wrapper fee for a personal pension and/or SIPP.SPEAK TO US TODAY

Case Study

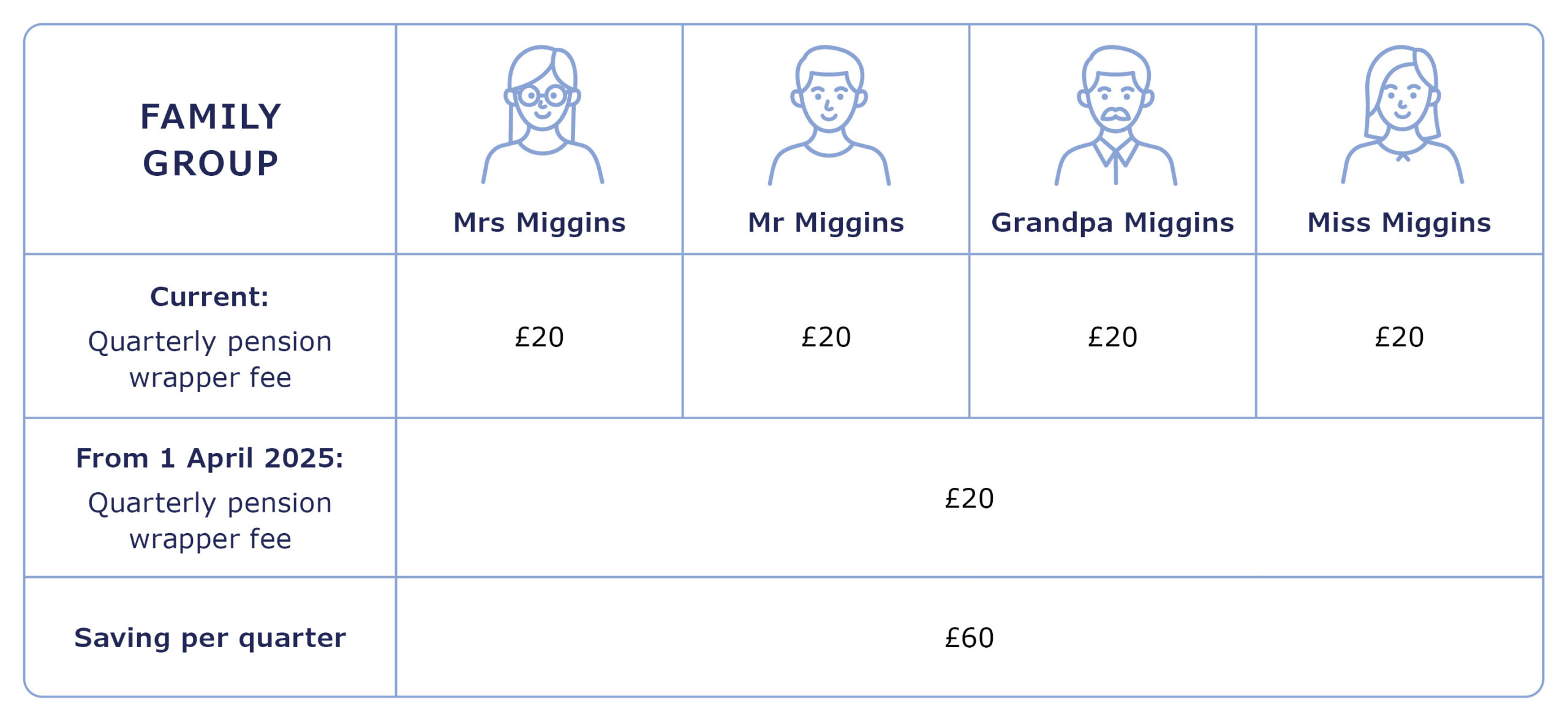

Mrs Miggins is in a linked family group with her husband, father-in-law and adult daughter. They each have a Personal Pension (PP) which currently has a wrapper fee of £20 per quarter. From 1 April 2025, a single PP wrapper fee will apply to the whole group rather than to each individual. This means they could each pay £5 per quarter.

A single individual in the family group can also be nominated to cover the full fee. This could be particularly beneficial for non-taxpayers in the group looking to maximise pension contributions.

A proven record of reducing costs

For 17 consecutive years, we have reduced our charges – setting an un-matched standard across the platform industry.

Our price reductions are a direct result of continuous platform enhancements and ongoing digitalisation. This enables us to create operational efficiencies and economies of scale – which we pass onto clients.

We are committed to delivering value and supporting long-term positive outcomes for clients. As a result of previous price reductions, Transact clients already benefit from:

- No buy commission

- No junior client portfolio wrapper fees.

Supporting intergenerational financial planning

The October Budget 2024 introduced several tax reforms creating additional wealth planning complexities for financial advisers and their clients. With pension death benefits in scope for inheritance tax (IHT) from 2027 and increases to capital gains tax rates, wealth and retirement planning now require the use of a more diverse range of tax wrappers, such as onshore and offshore bonds, as well as access to trusts.

Choosing the right platform is essential when considering long-term and intergenerational wealth planning needs. A basic platform may not have the products and services to cater to such complexity.

Why partner with Transact?

Transact has a track record for reducing prices, delivering exceptional service, continuous platform development and responding quickly to the changing needs of our users.

With almost 25 years of industry experience, we are a reliable partner offering a diverse range of products and services.