Transact Online (TOL) – Recent Enhancements

This month’s updates include the following:

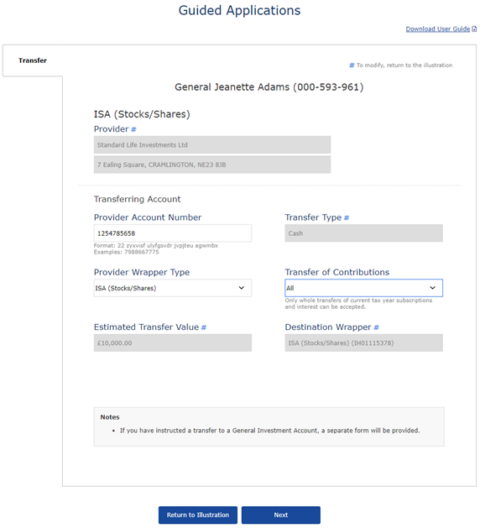

- Guided Application – Transfers for Existing Clients. In line with our digitalisation program we have now added the ability to add transfers for existing clients online via Guided Applications. This represents a huge step forward as 30% of transfers are for existing clients, and will benefit from:

- Validation – so that no data fields are missed, and everything is supplied.

- All transfer data captured online – so fewer errors.

- Provider validation – ensures you find the right provider and use the correct ‘policy number’ format.

- A faster service – access to a faster, streamlined checking process.

And those transfers which can be processed electronically will be processed much faster.

If you illustrate a transfer for an existing adult client, including portfolios in linked family groups, you will be offered the Guided Application route. For pension, ISA and LISA transfers, where the provider accepts electronic transfer instructions from us, you will receive a declaration at the end of the Guided Applications process to be signed by the client(s) (form T100D). If the ceding provider does not accept electronic transfer instructions, or it isn’t a pension/ISA/LISA transfer, the usual transfer form will be provided for signing.

- Withdrawal ‘Payment Reference’ – This feature allows you and your clients to add your own ‘Payment Reference’ to withdrawal instructions for your own reference (it will appear in their bank statement). All withdrawal types offer this, i.e. one-off withdrawal, regular withdrawal, sell then withdrawal, regular sweep and rebalance then withdrawal.

- Performance Analysis – A glossary has been added to the back of the Performance Analysis PDF to help you and your clients explain various performance measures.

If you need any help on any aspects of our service, please use Live Chat for a quick response, co-browse to screen share so that we can direct you or call our highly trained, dedicated Sales & Online Support team who support these functions via (020) 7608 5387.

- Introduction

- Transact Online (TOL) – Recent Enhancements

- Transfer Due Diligence Pension Scams

- Consumer Duty Actions

- Over 54% of Investor Clients have Logged in in the Last year

- Share Class Conversion

- Transact- BlackRock MPS Update

- Dealing with Pension Income Payments in Times of Uncertainty

- Fund Changes

- Interest on Cash Deposits

- Transact Events 2023