TRANSACT INHERITANCE TAX INDEX

Transact has continued to work with Trajectory, a team of strategic insight and foresight experts that help organisations understand the impacts of change. They helped us examine the most current issues surrounding inheritance tax (IHT).

- Households potentially liable for IHT to jump from 1.6 million to 5.1 million by 2027.

- Total taxable wealth to quadruple from £472bn to £1.9trn.

- One in four households in London and the South-East projected to exceed the £1m threshold.

The IHT Index monitors changes in British household wealth since 2006, using data from the Office for National Statistics’ Wealth and Assets Survey. This data is used to estimate the number of households that may be liable to IHT and the amount of tax that might be due.

Whether an individual’s estate is subject to IHT, and the amount of tax payable, will not only be subject to the value of the deceased’s estate on death, it will also be influenced by regulatory changes to the basis for the calculation of IHT. Good examples of this are the introduction of the residence nil rate band (RNRB), an additional IHT allowance available to deceased homeowners and, more recently, the proposals to include pension wealth in estate calculations from April 2027.

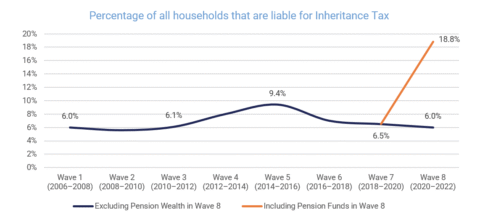

Given that household wealth is concentrated in property and pensions, these changes have a profound impact on the number of households potentially liable to IHT and the total IHT liability. Whilst the introduction of the RNRB led to a steady reduction in the number of households liable, the inclusion of pension wealth sees a dramatic reversal of this trend, potentially leading to a threefold increase, with nearly one in five households becoming liable for IHT.

Transact has created this index to raise awareness for financial advisers and their clients. An analysis of IHT has produced some interesting findings:

| Key Findings | |

|---|---|

| A sharp rise in affected households | Including pension wealth in estate valuations will more than triple the number of households potentially liable for IHT—from 6.0% to 18.8%—increasing from 1.6 million to 5.1 million households. |

| A fourfold increase in taxable wealth | The total value of potential household IHT liability is projected to rise from £472 billion to £1,924 billion. |

| A disproportionate impact by age and region | Households with a representative person over age 55 will see a jump in IHT exposure from 1.2 million to 3.8 million. The burden will be most pronounced in London and the South East, where over 25% of households are expected to exceed the £1 million threshold. |

| A widespread lack of awareness | Fewer than 30% of homeowners are fully aware of the 2027 changes, and a third remain completely unaware. While wealthier individuals show greater awareness and preparedness, there is a clear need for financial guidance in the broader population. |

| A strategic shift in planning | We should expect to see an increase in lifetime gifting with greater use of exempt transfers, potentially exempt transfers (PETs) and chargeable lifetime transfers (CLTs), as a primary mitigation strategy. For many, it may become more tax-efficient to withdraw and gift pension funds during retirement, despite the income tax implications. |

| An increase in inter-generational planning opportunities | Almost half of advisers (44%) of respondents in a Transact survey) believe that the IHT changes will have a positive impact on their business and will provide increased inter-generational planning opportunities. |

| An increase in the use of trusts, gifts and bonds | Advisers expect the use of trust-based planning, gifting out of surplus income, and investment bonds to be key financial strategies likely to be deployed to manage intergenerational wealth transfers and tax liabilities. |

The picture for UK households

The data illustrates a growing issue. The chart below shows the percentage of all households liable to IHT both before and after the inclusion of pension wealth in Wave 8 (the latest wave that data is available for). As can be seen, the inclusion of pension wealth increases the percentage of households liable to pay IHT from 6.0% to 18.8%.

Excluding pension wealth, we can see a reduction in the percentage of households liable from Wave 5 to Wave 8, from 9.4% to 6.0%. The primary reason for this reduction is the inclusion of the final phases of the RNRB.

The Transact Inheritance Tax (IHT) Index monitors changes in British household wealth (2006 to 2022) using data from the Office for National Statistics’ Wealth and Assets Survey. Liability Threshold Definition: Any household with total wealth (inc. pension wealth) at £1 million or higher.

The index is designed to raise awareness of IHT, allowing financial advisers who use our platform to more easily address the needs of their clients and track the ongoing potential liability of their clients.

You can find out more by reading the original and the most recent white paper below:

If you have any questions you can contact us.

This document is for use by financial professionals only. It is intended as general guidance only and should not be used as a recommendation to use or rely on any of the features mentioned. The information contained in this document is not advice, nor is it a substitute for advice.